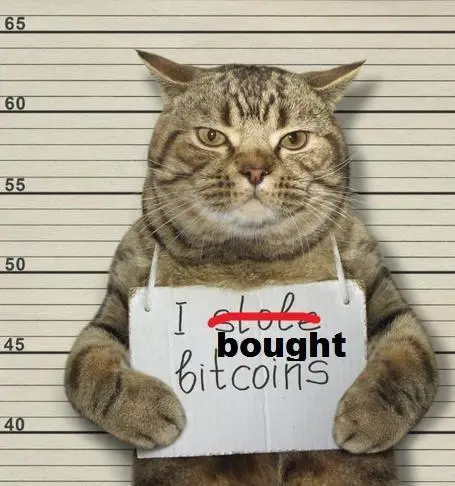

The U.S. Securities and Exchange Commission today hit four people with charges for allegedly swindling investors out of nearly $300 million in a “fraudulent crypto Ponzi scheme.” In a Friday announcement, the SEC said Trade Coin Club raised 82,000 in Bitcoin—worth $295 million at the time—from over 100,000 investors worldwide between 2016 to 2018. Trade Coin Club promised investors “minimum returns of 0.35% daily” from a “crypto asset trading bot,” but it wasn’t true—and instead functioned as a Ponzi scheme, the SEC alleged. The government body hit Douver Torres Braga, Joff Paradise, Keleionalani Akana Taylor, and Jonathan Tetreault for their alleged involvement in the “multi-level marketing program.” “We allege that Braga used Trade Coin Club to steal hundreds of millions from investors around the world and enrich himself by exploiting their interest in investing in digital assets,” Chief of the Enforcement Division’s Crypto Assets and Cyber Unit David Hirsch said Friday. “To ensure our markets are fair and safe, we will continue to use blockchain tracing and analytical tools to aid us in the pursuit of individuals who perpetrate securities fraud,” he said. Braga personally received at least $55 million in Bitcoin, while Paradise pocketed $1.4 million, Taylor $2.6 million, and Tetreault got around $625,000, the SEC claimed—all in the form of Bitcoin. We charged Douver Torres Braga, Joff Paradise, Keleionalani Akana Taylor, and Jonathan Tetreault for their roles in Trade Coin Club, a $295 million fraudulent crypto Ponzi scheme. — U.S. Securities and Exchange Commission (@SECGov) November 4, 2022 The charges include violation of the anti-fraud and securities registration provisions, as well as violation of broker-dealer registration provisions of the federal securities laws and asks the four to return the cash raised. Tetreault agreed to settle the SEC’s charges without admitting or denying the allegations, the statement added. By Mat Di Salvo, https://decrypt.co/113575/sec-trade-coin-club-bitcoin-ponzi