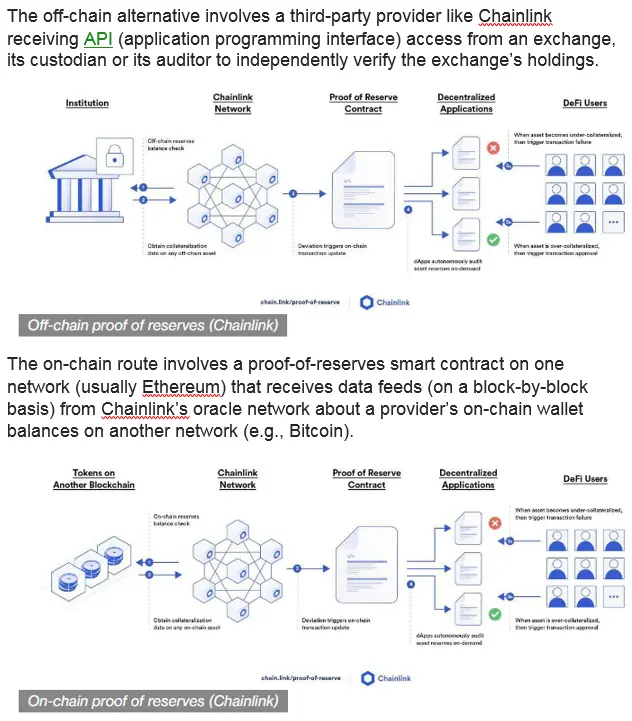

Crypto exchange FTX collapsed spectacularly into bankruptcy last week as trust in its accounting for billions of dollars in assets vanished. In the fiery aftermath, some critics are blasting the very existence of centralized exchanges like Sam Bankman-Fried’s, saying they haven’t been reliable stewards for customers’ assets. But the blowup has reinvigorated the discussion about a potential solution, something called "proof of reserves," or PoR, a way of showing – with little or no doubt – exactly how many tokens are at any exchange that adopts the technique. If in place at FTX, proof of reserves could have in theory prevented customers’ money from being moved where it shouldn’t have been (to Bankman-Fried’s trading firm Alameda Research). Binance, the world’s largest cryptocurrency exchange by volume, has already shared its wallet balances and says it plans to conduct a proof-of-reserves snapshot “in the next few weeks.” Other exchanges that have made similar commitments include Gate.io, KuCoin, Poloniex, Bitget, Huobi, OKX, Deribit and Bybit. Proof of reserves is an auditing technique used to confirm assets on hand. Stablecoin issuers like Paxos use it to prove they have sufficient assets backing their tokens, while exchanges like BitMEX use it to prove customer deposits correspond to assets in custody. “It would have been a pretty solvable problem if there was more transparency on the balance sheet. We already power multiple stablecoins and multiple gold coins and multiple financial institutions, where we prove their balance sheets through proof of reserves,” Sergey Nazarov told CoinDesk in an interview. Nazarov is the co-founder of oracle network Chainlink, which offers a proof-of-reserves product. ===How does proof of reserves work?=== There are several ways for an entity to prove its asset reserves, from traditional third-party audits by companies like Armanino to "Merkle tree proofs" (cryptographic verification via data structures called Merkle trees). Then there are methods employed by blockchain analytics companies. Chainlink, for example, separates proof-of-reserves implementation into two categories: off-chain and on-chain. The off-chain alternative involves a third-party provider like Chainlink receiving API (application programming interface) access from an exchange, its custodian or its auditor to independently verify the exchange’s holdings. The on-chain route involves a proof-of-reserves smart contract on one network (usually Ethereum) that receives data feeds (on a block-by-block basis) from Chainlink’s oracle network about a provider’s on-chain wallet balances on another network (e.g., Bitcoin). Either way, the result is users can verify a company is actually holding the assets it claims to be holding. By Frederick Munawa, AccessTimeIconNov 17, 2022, https://www.coindesk.com/tech/2022/11/17/proof-of-reserves-emerges-as-a-favored-way-to-prevent-another-ftx/