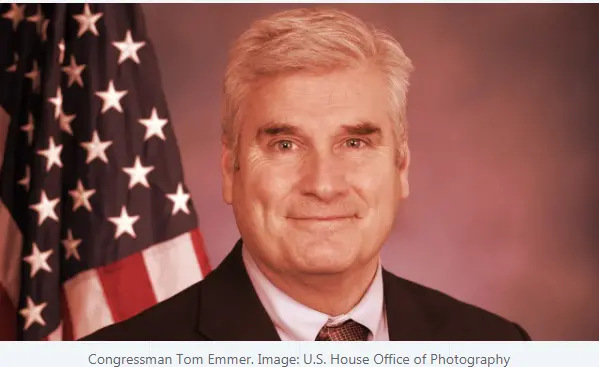

The Treasury Department has refused to answer a Republican lawmaker’s questions about the blacklisting of coin mixer Tornado Cash. Congressman Tom Emmer (MN-06) wrote a letter to the Department of the Treasury five months ago asking a number of questions surrounding its Tornado Cash ban, noting that “technology is neutral, and the expectation of privacy is normal.” Tornado Cash is a popular “coin mixer” app that allows people to anonymously send and receive Ethereum, the second biggest digital asset by market cap. But the Department of the Treasury’s Office of Foreign Assets Control (OFAC) banned U.S. citizens from using it last August, claiming that criminals were using it to launder dirty funds. “Because Tornado Cash remains the subject of active litigation, it would not be appropriate for Treasury to comment further on the entity’s designation at this time,” Assistant Secretary for Legislative Affairs at the Treasury Jonathan Davidson said in a Monday letter to Emmer, posted by the Republican lawmaker today. Emmer responded by saying in a tweet that tools like Tornado Cash are necessary for crypto transactions in order to preserve the same kind of privacy people expect from cash. He called the Treasury’s move to ban the app a “destructive policy decision.” The congressman had initially asked Treasury Secretary Janet Yellen to explain why the department had sanctioned a decentralized app—rather than a centralized entity operated by people—and pointed out that anonymizing software isn’t “subject to Bank Secrecy Act obligations.” He also pointed out that it wasn’t practical to sanction people who received Ethereum unwillingly from someone else using the app (a point proven when an anonymous troll sent celebrities with Ethereum wallets the anonymized cryptocurrency.) The Treasury Department did since clarify, however, that it would not seek to punish people who were "dusted" with cryptocurrency linked to Tornado Cash and would provide a legal avenue for individuals to withdraw funds from the platform without running afoul of sanctions. When the Feds decided to ban Tornado Cash in August of last year, it sent many in the crypto community up in arms. Coinbase, the biggest digital asset exchange in the U.S., is funding a lawsuit against the Treasury Department for the move, claiming the ban is “punishing people who did nothing wrong and results in people having less privacy and security.” Authorities claim the app was being used by North Korean state-sponsored hacking group Lazarus Group as a go-to tool for obscuring stolen funds. The Feds first said that over $7 billion-worth of dirty digital cash passed through Tornado since its creation in 2019. Blockchain data company Elliptic, however, later claimed in a report that only $1.5 billion of $7.6 billion that passed through the app was from illegal activity. By Mat Di Salvo, Jan 11, 2023, https://decrypt.co/118949/treasury-questions-congressman-emmer-tornado-cash