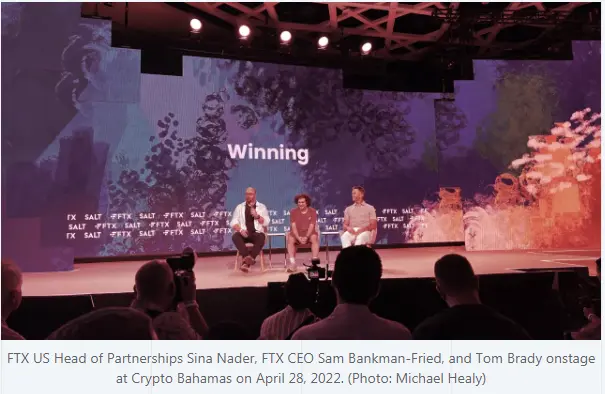

Is there anything we can learn from the whole disaster? ==== 1 ==== The fall of another false crypto idol The crypto industry has a way of building founders into idols to lionize, even though that flies directly in the face of Web3's utopian ideal of decentralization. They did it with Terra founder Do Kwon, Three Arrows Capital figurehead Su Zhu, and Celsius founder That's not to excuse Sam's conduct or his agency in this mess. He embraced and fueled his own celebrity by putting himself on billboards (how many other tech companies use their dweeby founder as the face of their marketing?), and his explanations so far for the collapse of his business have been either weak (he tweeted that his "sense" of users' margins and FTX's leverage was off—why didn't the CEO have the correct sense of his own company's leverage?) or willfully dishonest (he claimed Alameda wasn't insolvent, just illiquid, because it had "more assets than liabilities" on a mark-to-market basis—an absurd claim). But other parties also bear some blame for creating the cult of SBF. The media (crypto and mainstream) made him famous. So many magazine covers! And . And crypto enthusiasts made him a folk hero, with every quirk (he dressed like an eighth grader! he plays video games while doing television interviews!) only making him a more interesting profile subject. ==== 2 ==== A plot twist at the end of a business rivalry It is nothing short of remarkable that Changpeng "CZ" Zhao would emerge the victor in his public rivalry with SBF. For those not steeped in the history here: Binance, the largest crypto exchange in the world by volume, was actually an early investor in FTX in 2019. After the two exchanges became public competitors, FTX cashed out Binance's equity stake in July 2021 in the form of FTT tokens—leaving Binance with a and thus didn't need to play by any one jurisdiction's rules; SBF was Mr. Washington, befriending Maxine Waters and wining and dining Congressional staffers, advocating for sensible crypto regulations. The stage was set for Sam to be the torch-bearer who would take crypto mainstream, bridging the gaps between the DeFi degens, Wall Street, and Washington. Instead, he bent the knee to his rival by announcing he would sell FTX to Binance—only to have CZ stick the knife in by changing his mind the next day, declaring FTX was "beyond our ability to help." It is a series of events practically scripted for the movies, and there will be multiple movies made. CZ walks away from this mess looking like a mad genius—for now. === 3 ==== Victory lap for DeFi advocates DeFi advocates have used the FTX collapse, as they used the failures of crypto lenders Celsius and Voyager, to say some form of "that's what you get for putting your crypto on a centralized exchange" and to point out that And they're correct. As Decrypt's DeFi guy Liam Kelly recently wrote, decentralized crypto platforms like Aave, Compound, and Uniswap have kept working through recent meltdowns of centralized players. If you trust your funds to human beings, you're trusting the decisions they make with your money. SBF and the other people running FTX were funneling those funds to other purposes. Just like Bitcoin maximalists have been able to point to the Terra crisis and now the FTX crisis (specifically FTT's role in it) and point out that Bitcoin keeps working while altcoins have failed, DeFi advocates have been handed another chance to point and say "We told you." Not your keys, not your crypto, and so on. === 4 === Centralized crypto exchanges are not dead There's just one problem for the DeFi flag-wavers: The user experience of DeFi is still so thorny and opaque as to be unusable for most non-tech-savvy folks. The easy on-ramps are just not there yet. So this is not the end of centralized exchanges. The average "normie" who decides they're ready to buy a bit of crypto is not going to do it on Uniswap; they're going to choose an exchange they think looks reasonably trustworthy. If they're in the U.S., they're probably going to choose Coinbase. Indeed, Coinbase has wisely used the FTX collapse as a situational marketing opportunity to point out that it doesn't even have an exchange token and never trades with customer funds. Lots of true degens hate Coinbase for being too Wall Street or too overly compliant, but Coinbase is the closest thing to a household brand name in crypto, and because it's publicly traded and has been around since 2012, people are going to continue using it. ==== 5 ===== More bad for the industry than good Some optimists have called the FTX collapse a net positive for crypto, because it's another event that washes out bad actors and speculators. "Crypto will emerge stronger," et cetera. While I truly respect that spirit, a little hard realism might be more productive: The FTX fiasco is really bad for crypto. It's given all the virulent crypto skeptics another chance to point and laugh and say all of crypto is a house of cards, and it's given politicians who already viewed crypto as a high-risk casino a chance to scream more loudly for stricter regulations. Sam and FTX have not done their peers any favors. The public should not equate another bad company with the entire industry, but I do believe it's going to take a long time for the reputation of crypto to recover from this black eye. By Daniel Roberts, Nov 28, 2022, https://decrypt.co/114308/5-ways-of-looking-at-sbf-ftx-bankruptcy-collapse