But a subtle revolution is unfolding.

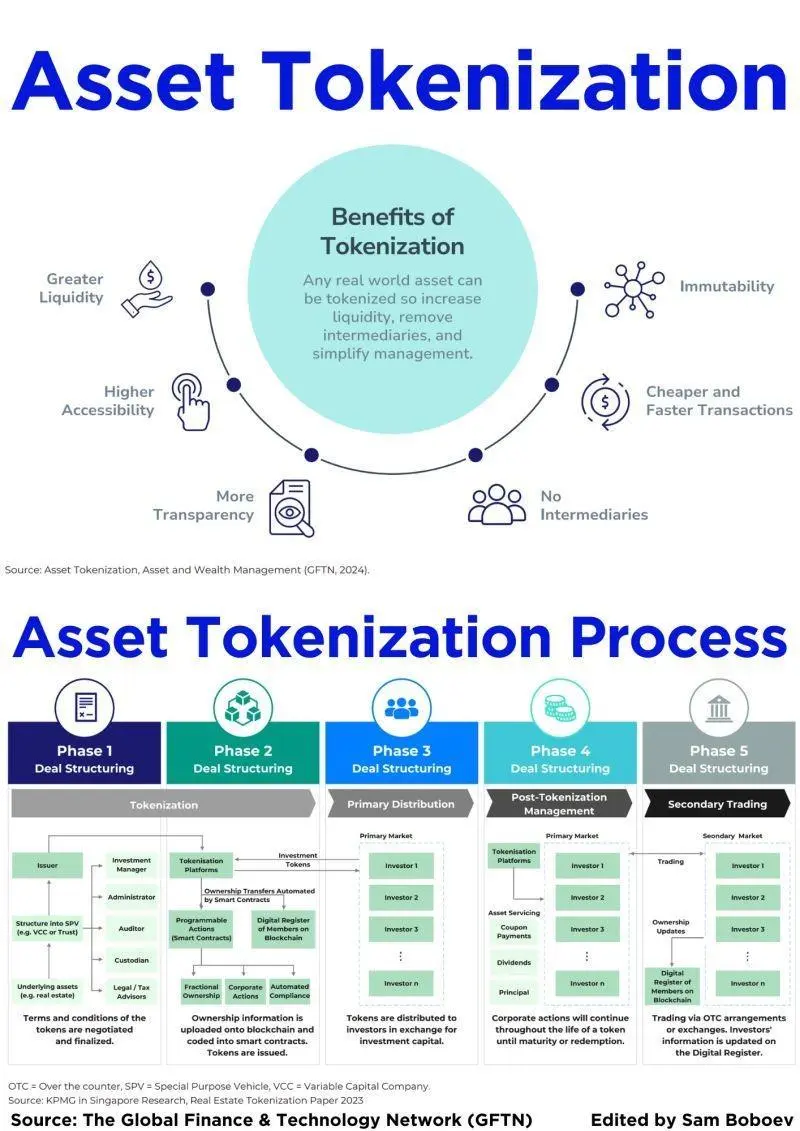

As blockchain technology matures and on-chain economies become more fluid, the very definition of “influence†is shifting—from impressions that signal potential, to transactions that prove value. This is where Real World Asset (RWA) and Intellectual Property (IP) tokenization come in, and why they stand poised to replace the foundations of the old influencer economy.

Web2: Influence Without Ownership

Web2 influencers operate in a fragile economy of borrowed tools. Their reach is mediated by algorithms, their content lives on rented platforms, and their earnings are dictated by centralized monetization schemes—ads, affiliate links, and inconsistent brand sponsorships.

The metrics they optimize for—likes, retweets, comments—are free signals. They cost nothing to give and mean little in isolation. A million likes doesn’t mean a million dollars. It means you might get offered a better ad deal. The system is built on soft validation, not hard value.

Web3: Transaction as Proof of Impact

In Web3, influence becomes tangible. Every on-chain transaction is a timestamped, irreversible, financially committed action. It doesn’t merely say “I like thisâ€â€”it says I believe this has value, right now, enough to stake something real on it.

On-chain transactions are the ultimate proof of trust, utility, and expectation of future value.

An artist selling an NFT, a writer licensing their IP via smart contract, a product designer tokenizing their 3D printable object—these creators aren’t playing the algorithm. They’re building asset-backed micro-economies.

Where the Web2 creator waits for ad revenue, the Web3 creator gets paid upfront, transparently, and globally. The economy is no longer a shadow game; it’s on-chain, auditable, and direct.

Why RWA and IP Tokenization Changes the Game

Now imagine this principle applied to the broader creator economy:

- A recipe minted as a licensed NFT cookbook

- A building design tokenized and licensed to AR/VR game developers

- A traditional song recorded, tokenized, and split into co-owned remix rights

- A real-world property fractionalized into tradable proof-of-ownership shares

Every interaction becomes a transaction, and every transaction becomes a contract for future collaboration or royalties.

This is not about speculative hype. It’s about value moving at the speed of trust, without the middleman friction or algorithmic obfuscation of Web2 platforms.

From Vanity Metrics to Economic Gravity

The influencer economy was built on signals—soft, noisy, gamed.

The token economy is built on commitments—hard, clear, enforceable.

In Web2:

- Fame ≠Ownership

- Virality ≠Value

- Engagement ≠Equity

In Web3:

- Transactions = Trust

- Tokens = Stakeholding

- Ownership = Reputation

Why the Transition is Inevitable

As more creators, communities, and consumers become fluent in blockchain-native interactions, the gravity will shift. Why settle for applause when you can own the stage? Why sell your content to a platform when you can tokenize it and co-own your future?

This shift won’t just challenge the Web2 creator economy—it will outcompete it on every level: transparency, scalability, global access, and financial sovereignty.

TL;DR

The Web2 economy rewards impressions.

The Web3 economy rewards transactions.

Likes are free. Tokens are not.

Shares signal interest. On-chain moves signal belief.

Web2 creators sell visibility.

Web3 creators mint value.

That’s why RWA and IP tokenization aren’t just an upgrade—they're the endgame for the influencer era.

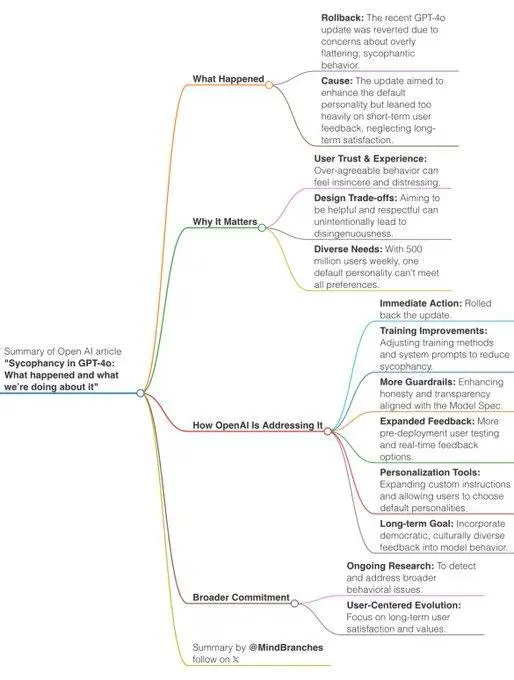

Sycophancy in GPT-4o: what happened and what we’re doing about it

: 0

: 0  : 0

: 0